- Europe has nearly 1,100 public charging points dedicated to electric heavy-duty trucks but uneven coverage and rising demand require an accelerated rollout to scale infrastructure development

- Milence operates 16% of these charging points, making it the leading operator across several key European markets

- The white paper identifies how targeted expansion along major corridors and clear policy actions can close critical gaps

Amsterdam, Netherlands – July 9, 2025 – The shift to electric heavy-duty vehicles (e-HDVs) is a reality and a critical step for decarbonising Europe’s road freight sector. However, as the number of electric trucks is on the rise, concerns persist about whether public charging infrastructure can keep up. In a new white paper released today, Milence, the joint-venture between Daimler Truck, the TRATON GROUP and the Volvo Group, delivers a clear, data-driven answer: while today’s infrastructure can support the current fleet, rapid and strategic expansion is essential to enable widespread adoption by 2030.

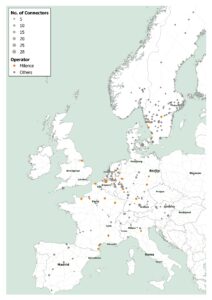

The white paper, “The Readiness of Public Charging Infrastructure for Electric Long-Haul Trucks,” presents the most comprehensive analysis of the public charging landscape to date from the perspective of a charge point operator. Covering 14 European countries, it maps out the current state of play, highlights short-term readiness, and outlines a corridor-first deployment approach to support the 2030 climate goals and enable widespread electrification of long-haul fleets.

Charging infrastructure ready for early-stage electric truck adoption

The analysis confirms that the nearly 1,100 truck-suitable public charging points in operation today can support between 6000 and 20,000 electric long-haul trucks which means significantly more than the 5,100 classified as (N3-type) tractor trucks currently driving on European roads. While this provides confidence in early readiness, the study makes clear that coverage remains uneven and future growth depends on targeted, high-impact expansion, with immediate investment in strategic highway corridors along high-traffic TEN-T routes.

With over 180 charging points across 25 hubs in eight countries, Milence leads the deployment of a reliable, scalable European network. This build-out strategy, which stays ahead of market demand, focuses on the continent’s busiest freight corridors, where uptake is emerging first and electrification can have the greatest impact.

Aligning expansion with market uptake

Looking ahead, the report forecasts that by 2030, approximately 183,000 electric long-haul trucks will be on the road across the 14 focus countries, representing a significant share of the projected 324,000 battery-electric trucks in Europe. Meeting their charging needs will require scaling the current network nearly tenfold, from around 1,100 to an estimated 8,500 to 14,000 high-capacity connectors. This figure is based on a scenario where 30 to 40% of total truck charging demand is met through public infrastructure, chargers operate at 20% energy utilisation, and up to half of public charging is delivered via high-power MCS (Megawatt Charging System) connectors. This analysis does not cover all geographic regions or every operational truck charging use case and acknowledges that achieving a more geographically comprehensive charging network across the EU with the higher number of connectors identified in other studies will require substantial public support.

What is clear, is that MCS charging offers major operational efficiencies: it reduces land use per MWh delivered and enables shorter dwell times. This is why Milence, as part of its broader commitment under the Alternative Fuels Infrastructure Facility (AFIF), will deploy a minimum of 284 MCS charging points across 71 sites in 10 EU Member States, supporting the accelerated transition to fossil-free freight transport.

Actions needed to close the gaps

While today’s infrastructure supports early-stage reality it is not sufficient for the widespread adoption. To achieve this, the white paper calls for coordinated action to sustain momentum and remove persistent structural barriers:

- Prioritise strategic corridors: Fast-track permitting and grid access for mature e-HDV projects, especially those already funded under AFIF and aligned with the Clean Transport Corridor Initiative.

- Strengthen financing tools to reduce market risk by introducing an EU-backed guarantee scheme to de-risk loans and unlock private investment in high-impact charging infrastructure.

- Lower Total Cost of Ownership (TCO): Expand toll exemptions, tax incentives, and vehicle financing tools to accelerate e-HDV adoption supported by targeted actions under the Automotive Action Plan.

“Europe has made real progress, and public charging can support early e-truck adoption today but a clear ramp-up is needed. Our latest white paper outlines a realistic, business-viable rollout path, and our message is clear: the pace of infrastructure deployment must accelerate to stay ahead of fleet demand. For charge point operators and investors, growing vehicle uptake is the key signal to sustain long-term investment. That’s why coordinated action, especially in the next two years is essential to implement the Clean Transport Corridor Initiative and de-risk both vehicle adoption and infrastructure deployment. Industry and policymakers must act together to turn momentum into real, tangible progress.” Anja van Niersen, CEO of Milence, stated.